Franchise Disclosure Document: How to Review an FDD

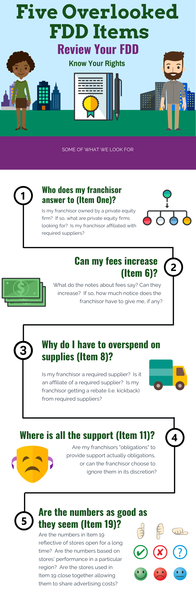

If you’re interested in buying a franchise, one aspect of the pre-sale process that you will become familiar with is the Franchise Disclosure Document, or the FDD. This is a required legal document that discloses a lot of the important information about the franchise but it is often overly complicated and not easy to understand.

The FDD will include information related to legal or financial troubles the franchisor may have had. It will also include information about both parties’ obligations and initial investments; how to resolve disputes; specifics about trademarks; and any restrictions that apply. Because these details are extremely important when considering a major investment like a franchise, you may want an attorney to review your FDD.

5 Important Parts of Franchise Agreements

- Required suppliers: Information on any vendors or suppliers with which the franchisee will be required to deal, including whether the franchisor itself is such a supplier.

- Pricing: Information on the upfront price the franchisee must pay to the franchisor, as well as information on the estimated total initial investment to open the franchise.

- Ad spend obligations: Information on the franchisor’s obligation to support franchisees with marketing and advertising, and the franchisee’s required spending on local and national advertising.

- Fees and increases: Information on the ongoing costs of franchising ownership. These include fees such as the monthly royalty fee, advertising or marketing fee, and any other fee.

- Training and assistance: Information on the franchisor’s obligation to provide training and support services.

How to Review an FDD

As with most legal documents, an FDD can be very complex and hard to understand without a legal background, which is why you may want to bring in an FDD attorney to review. The relationship between a franchisor and a franchisee is different from a traditional one-and-done business sale, so the FDD will lay out important information and expectations from both sides.

The problem is, since legal documents can be lengthy and full of jargon, the franchisee could miss something in the FDD that could later create an issue. If the franchise agreement has already been signed, however, there may be no recourse for the franchisee, even with the help of a lawyer. Bringing in an FDD attorney early in the process can help identify and eliminate potential issues.

Why You Should Have an Attorney Review an FDD

If not for anything else, a franchisee should have an attorney review their FDD for peace of mind. Your attorney will ensure that you are getting the best deal with your franchise, and there should be no hidden surprises later.

FDDs also have to be updated and renewed no less than once a year, so it is always a smart idea to have an attorney review the FDD to be sure it is up to date and in compliance with applicable law.

One simple FFD rule to live by is this: Don’t sign anything from a franchisor until counsel reviews it first.

If you’re curious about franchising or have questions about your Franchise Disclosure Document, contact us today!